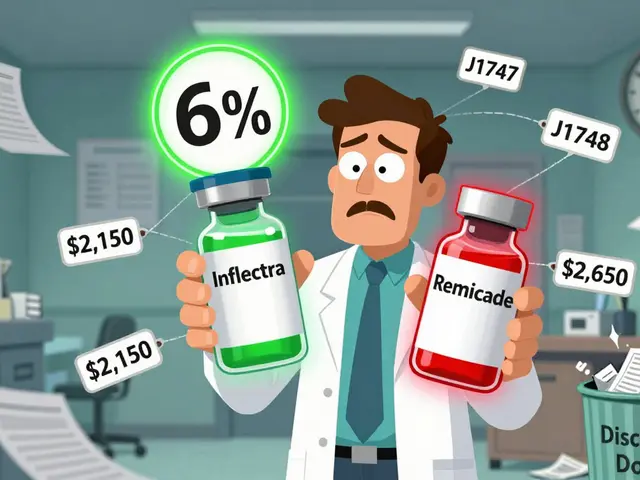

When a doctor gives a patient a biosimilar drug like Inflectra or Renflexis instead of the brand-name Remicade, the billing process isn’t as simple as handing over a generic pill. Unlike traditional generics, biosimilars don’t get lumped into one billing code. Each one has its own unique identifier, and how much the provider gets paid depends on a complex formula tied to the drug’s actual selling price. This isn’t just paperwork-it directly affects whether a clinic chooses to use a cheaper biosimilar or sticks with the more expensive original.

How Biosimilar Coding Works Today

Since January 2018, every FDA-approved biosimilar has been assigned its own HCPCS code. These are either J-codes (permanent) or Q-codes (temporary, until a permanent code is issued). For example, Inflectra (infliximab-dyyb) uses J1747, while Renflexis (infliximab-abda) uses J1748. These codes are not interchangeable. If a provider bills J1747 but gave Renflexis, the claim will be denied.

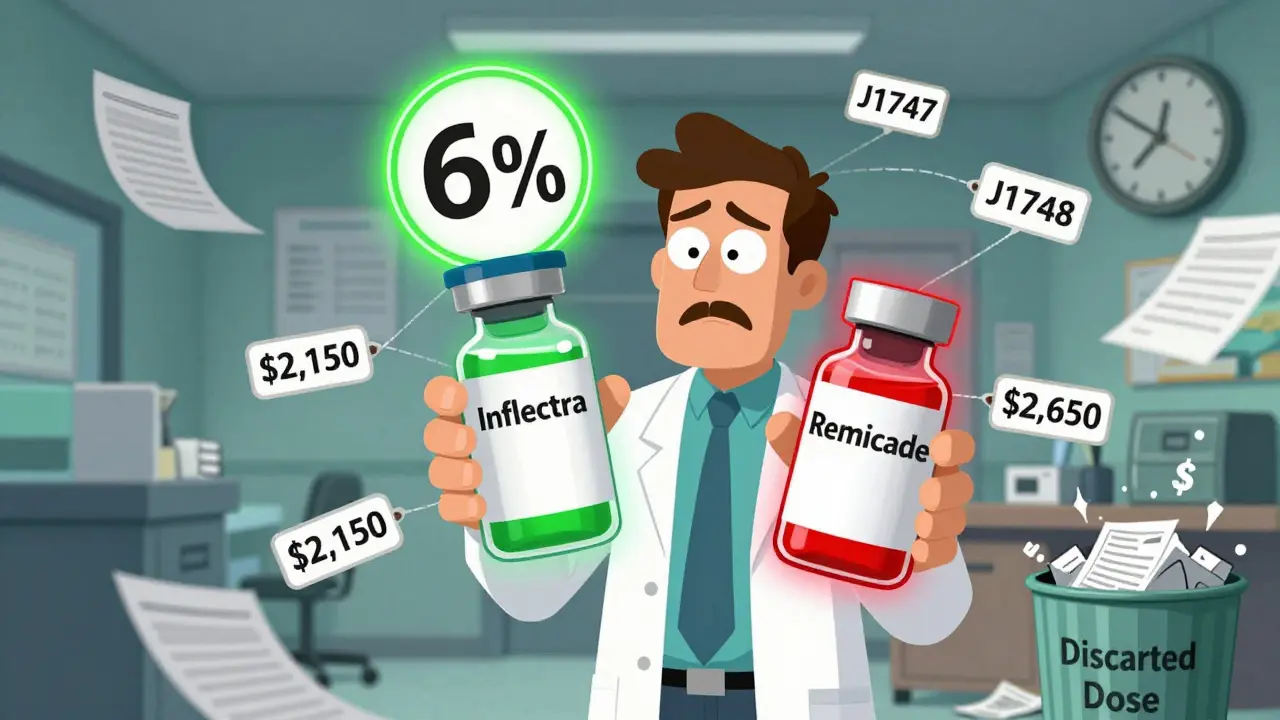

Before 2018, all infliximab biosimilars shared one code: Q5101. That created a big problem. If one biosimilar came in at a lower price, the reimbursement rate was averaged across all products. That meant manufacturers of cheaper biosimilars got paid less than they should’ve-because the system rewarded the more expensive options. The 2018 change fixed that. Now, each biosimilar gets paid based on its own Average Selling Price (ASP), plus 6% of the reference product’s ASP. That’s the key: the 6% add-on isn’t based on the biosimilar’s price. It’s based on the brand-name drug’s price.

How Reimbursement Is Calculated

Here’s the math: Providers are paid 100% of the biosimilar’s ASP, plus 6% of the reference biologic’s ASP. So if Inflectra’s ASP is $2,000 per dose and Remicade’s ASP is $2,500, the provider gets $2,000 + (6% of $2,500) = $2,150. That sounds fair-until you compare it to what they get for Remicade itself. For Remicade, they get $2,500 + (6% of $2,500) = $2,650. That’s a $500 difference per dose. Even though Inflectra is 20% cheaper, the provider still makes $500 more per dose by giving the brand-name drug.

This structure creates a hidden financial incentive to avoid biosimilars. A 2020 study from MIT’s Center for Biomedical Innovation showed that for every $100 saved on the drug cost, providers only gained $6 in reimbursement-because the 6% is tied to the higher-priced reference product. In Europe, where reimbursement is based on the lowest price in the class, biosimilar adoption hit 80%. In the U.S., after five years, infliximab biosimilars still only make up about 35% of the market.

The JZ Modifier: A New Layer of Complexity

On July 1, 2023, CMS added another rule: the JZ modifier. This modifier must be added to claims for infliximab and its biosimilars when no drug is discarded. That means if a vial contains 100 mg and you use all of it, you report the JZ modifier. If you throw away 20 mg, you don’t. This sounds minor, but it added real work. A gastroenterology practice in Ohio reported a 30% increase in billing staff time just to track discarded amounts. The goal was to prevent overbilling when providers used multiple vials for one patient. But the system doesn’t always account for real-world variability in dosing.

Providers who missed the JZ modifier in the first few months saw claim denials. Training became essential. Fresenius Kabi, a biosimilar maker, released a detailed coding guide in 2023. In a survey of 120 clinics, 87% said it helped reduce billing errors. But that’s still a lot of extra work for a system that should be simpler.

What Providers Actually Experience

A 2022 survey of 217 cancer centers by the Community Oncology Alliance found that 68% had trouble with billing during the 2018 transition to individual codes. Forty-two percent had claims denied because the wrong J-code was used. Even now, 22% of denials come from using outdated codes-because CMS updates pricing every quarter, and many clinics don’t check the new list.

One oncology clinic in Texas switched to a dual-verification system: the pharmacist checks the drug vial, and the billing staff cross-references it with the HCPCS code before submitting. That cut their error rate from 15% to under 3%. But not every clinic has the staff or budget for that.

And it’s not just Medicare. Medicare Advantage plans, which cover many patients, often pay differently-sometimes only 100% to 103% of ASP, without the 6% add-on. Commercial insurers vary even more. So a provider might get $2,150 from Medicare but only $1,900 from a private plan for the same drug. That inconsistency makes financial planning nearly impossible.

Why This Matters for Patients and the System

The real cost of this system isn’t just in billing errors. It’s in missed savings. The U.S. spent $12.3 billion on biosimilars in 2022, but because reimbursement doesn’t fully reward cost savings, adoption is slow. If the 6% add-on were based on the biosimilar’s own ASP instead of the reference product’s, Avalere Health estimates biosimilar use could jump by 15 to 20 percentage points. That could save Medicare billions.

Right now, biosimilar manufacturers time their launches to match CMS’s quarterly payment updates. They know the first few months after a launch are critical. But the system still favors the original drug. Even when biosimilars are 20-30% cheaper, providers often stick with the brand because the profit margin is higher.

What’s Next?

CMS is reviewing whether to change the 6% add-on structure. One proposal would tie the add-on to the biosimilar’s own ASP. Another, from MedPAC, suggests blending all drugs in a class-paying 106% of the weighted average price across all versions. That’s how Europe works. It’s simpler and pushes providers toward the cheapest option.

But changing the system isn’t easy. Drugmakers worry that if reimbursement drops too much, they won’t recoup R&D costs. CMS wants to encourage competition but also protect patient access. Right now, the system is stuck in the middle: it allows biosimilars to exist but doesn’t give providers a strong reason to choose them.

The future of biosimilars in the U.S. depends on whether policymakers can fix the payment mismatch. Until then, the billing process will remain confusing, the incentives will stay misaligned, and the savings will stay out of reach.

Do biosimilars have the same HCPCS code as the brand-name drug?

No. Each biosimilar has its own unique HCPCS code (J-code or Q-code), separate from the reference biologic. For example, Remicade (infliximab) uses J1745, while Inflectra uses J1747. This allows CMS to track each product’s usage and payment individually.

Why do providers sometimes prefer the brand-name biologic over the biosimilar?

Because reimbursement is based on 100% of the biosimilar’s ASP plus 6% of the brand-name drug’s ASP. If the brand costs $2,500 and the biosimilar costs $2,000, the provider gets $2,650 for the brand and $2,150 for the biosimilar-a $500 difference per dose. Even though the biosimilar is cheaper, the provider earns more by using the original.

What is the JZ modifier and when is it required?

The JZ modifier is required on claims for infliximab and its biosimilars when no drug is discarded from the vial. For example, if a 100 mg vial is fully used for a single patient, the JZ modifier is added. If part of the vial is thrown away, it’s not used. This rule, effective July 1, 2023, helps prevent overbilling but adds administrative steps for providers.

How often are biosimilar reimbursement rates updated?

CMS updates biosimilar payment rates quarterly, based on the latest Average Selling Price (ASP) data. These updates are published in the Medicare Physician Fee Schedule. Providers must check the updated codes and rates each quarter to avoid claim denials.

Why is biosimilar adoption lower in the U.S. than in Europe?

In Europe, many countries use reference pricing or tendering systems that pay the same amount for all drugs in a class, pushing providers to choose the lowest-cost option. In the U.S., the reimbursement formula still favors the more expensive reference product due to the 6% add-on based on its price. This reduces the financial incentive for providers to switch, even when biosimilars are significantly cheaper.

Kacey Yates

January 29, 2026 AT 20:20Why is this still a mess? Biosimilars are cheaper but providers get paid LESS to use them? That’s not a bug, it’s a feature for Big Pharma. The 6% add-on on the brand’s price is pure theft. CMS is literally subsidizing Remicade while punishing Inflectra. Fix this or shut it down.

ryan Sifontes

January 31, 2026 AT 04:24they told us biosimilars would save money but now i think its all a lie. the gov just wants us to think we’re getting a deal while the real winners are the big pharma lobbyists. you ever notice how the same people who made remicade also own the biosimilars now? coincidence? i think not.

Laura Arnal

January 31, 2026 AT 16:23Y’all are overcomplicating this 😅 The system’s broken but we can fix it! If we tie the 6% to the biosimilar’s own ASP instead of the brand’s, adoption skyrockets. Providers win, patients win, Medicare wins. It’s not magic-it’s math. Let’s push for this change! 💪

Eli In

February 2, 2026 AT 03:37Love how Europe just says ‘use the cheapest’ and gets 80% adoption. We over-engineer everything here. Why do we need J-codes, Q-codes, JZ modifiers, and quarterly updates? Just pay 106% of the average price like everyone else. Simpler = better. 🌍✨

Sheryl Dhlamini

February 3, 2026 AT 05:30I work in a small clinic. We had to hire an extra billing person just to handle the biosimilar codes. We’re not a hospital. We’re one MD and two nurses. The JZ modifier? We missed it for three months. Claims got denied. We cried. Not dramatic. Just true.

Doug Gray

February 4, 2026 AT 02:34The structural asymmetry of reimbursement creates a pathological incentive gradient wherein the marginal utility of prescribing the reference product exceeds that of the biosimilar, despite equivalent clinical efficacy. The 6% add-on functions as a regressive subsidy, reinforcing monopolistic rent extraction under the guise of innovation. We’re not fixing billing-we’re preserving rent-seeking.

Kristie Horst

February 4, 2026 AT 08:27Oh, so the government wants us to save money... but only if we jump through 17 hoops, hire a coding specialist, and pray the CMS database updates on time. How very thoughtful. 🙃 I bet the folks who designed this system never had to file a claim after 8 PM.

Andy Steenberge

February 5, 2026 AT 01:34Here’s what actually works: pay providers 106% of the lowest-priced drug in the class. That’s how Europe does it. No J-codes for every variant. No tracking discarded milligrams. No quarterly code updates. Just one rate. Providers pick the cheapest. Patients get savings. Manufacturers compete on price, not lobbying. It’s elegant. We’re overcomplicating a simple problem because we’re scared of real reform.

DHARMAN CHELLANI

February 6, 2026 AT 06:26USA bad. Europe good. Why you so dumb? Just pay less for same thing. Pharma rich. Patients poor. JZ modifier? LOL. Just use one code. Done.

Keith Oliver

February 6, 2026 AT 17:20Y’all still don’t get it. The 6% isn’t the problem. The problem is you’re all too lazy to learn the damn codes. I’ve been doing this for 12 years. If you can’t keep up with CMS updates, you shouldn’t be prescribing. Stop blaming the system. Fix your workflow. And yes, I’ve seen clinics with zero errors. They’re not magic. They’re organized.