When your monthly prescription costs more than your rent, you’ll try anything to cut the cost. That’s why millions of people in the UK and US turn to prescription discount programs and coupons. But do they actually work? Or are they just another confusing tool that leaves you frustrated at the pharmacy counter?

How These Programs Actually Work

Prescription discount programs come in three main types: manufacturer coupons, third-party discount cards like GoodRx, and patient assistance programs run by clinics or nonprofits. Each works differently, and not all of them save you money the same way. Manufacturer coupons are usually offered by drug companies for brand-name medications. You sign up online, print or download a code, and show it at the pharmacy. The coupon lowers your out-of-pocket cost at the register. But here’s the catch: it doesn’t change the list price of the drug. The pharmacy gets paid the full amount, and the manufacturer covers your discount. This can make your insurance pay more later, especially if you’re on Medicare Part D. Third-party discount cards like GoodRx, Blink Health, and SingleCare are different. They negotiate cash prices directly with pharmacies. You don’t need insurance. You just enter your drug name and zip code, and they show you the lowest price nearby. For generics, this often means huge savings. A 30-day supply of metformin that costs £45 with insurance might drop to £8 with GoodRx. That’s an 80% drop. Patient assistance programs (PAPs) are for people with no insurance or very low income. These are run by charities or hospitals. You apply, prove your income, and if you qualify, you get the medication for free. One clinic in Tennessee saved patients over £2,800 per person on average over 13 months. But these programs take time. You need paperwork, proof of income, and sometimes a doctor’s letter.When They Work Best - and When They Don’t

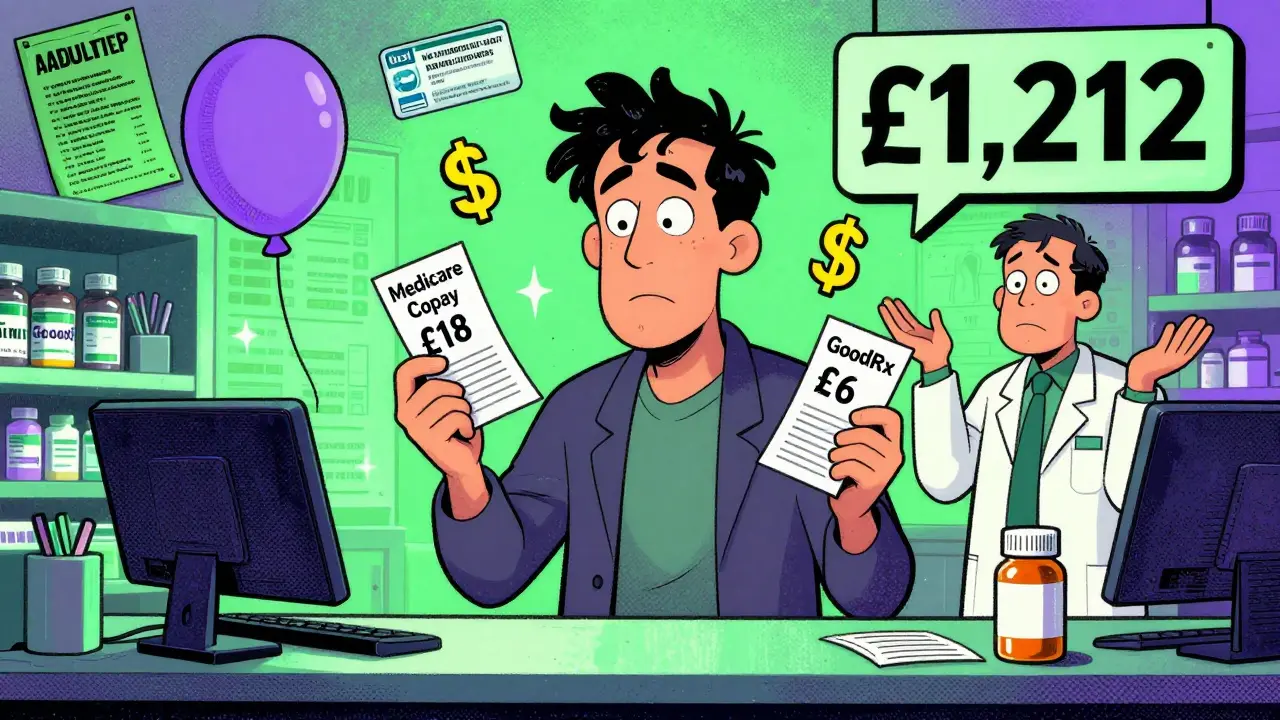

The biggest factor in whether a discount works is whether your drug is generic or brand-name. For generics, discount cards win every time. A 2022 study found that GoodRx saved users an average of 65% on generic drugs. For common medications like lisinopril, levothyroxine, or atorvastatin, you could easily save £20-£50 per prescription. Many people on Medicare Part D use these cards because their insurance copay is higher than the cash price. But for brand-name drugs? The savings vanish. A heart failure medication that costs £1,300 might drop to £1,212 with a coupon. That’s a £88 saving - barely enough to cover the bus ride to the pharmacy. Manufacturer coupons for brand-name drugs often just shift the cost from you to your insurer or taxpayer-funded programs like Medicare. There’s another problem: some insurance plans, especially Medicare Part D, won’t let you use a manufacturer coupon at all. If you try, your prescription might get denied. Even if it goes through, the discount doesn’t count toward your out-of-pocket maximum. So you’re paying less now, but you’ll hit the cap slower - meaning you pay more later.Real People, Real Savings (and Real Frustrations)

Take Sarah, 68, from Manchester. She takes metformin for type 2 diabetes. Her Medicare Part D copay was £18 for a 30-day supply. She tried GoodRx and found a local pharmacy offering it for £6. She switched. Now she saves £12 every month - £144 a year. That’s a new pair of shoes, or groceries for two weeks. Then there’s James, 52, with chronic pain. He takes Lyrica, a brand-name drug. His manufacturer coupon gave him £1.20 off a £48 prescription. He was disappointed. He tried GoodRx. Same price. He called three pharmacies. No difference. He ended up paying full price because the coupon didn’t help at all. A survey by the Medicare Rights Center found that 68% of seniors who used discount cards were happy - but 42% didn’t know whether to use their insurance or the card. That confusion is common. Pharmacists sometimes don’t know how to process the codes. One in four users reported being turned away or given the wrong price. GoodRx has a 4.3/5 rating on Trustpilot. Most positive reviews mention the app’s ease of use and cheap generics. The biggest complaints? Inconsistent pricing between nearby pharmacies, and almost no savings on brand-name drugs.

The Hidden Costs - Who Really Pays?

Here’s the uncomfortable truth: discount coupons don’t make drugs cheaper. They just move the cost around. When you use a manufacturer coupon for a brand-name drug, your insurer ends up paying more. Medicare pays more. And since insurers raise premiums to cover those costs, everyone else pays more too. The Congressional Budget Office estimates these coupons could add £2.7 billion to Medicare spending each year. They also hurt generic drug sales. When coupons make brand-name drugs feel affordable, people stop switching to cheaper generics. That’s bad for the system. One study found coupon use increased brand-name drug demand by 60% - while cutting generic sales by the same amount. That’s why the American Medical Association and the FTC are watching closely. They worry these programs encourage doctors to prescribe expensive drugs when cheaper, equally effective options exist.How to Use Them Without Getting Screwed

If you want to save money, here’s how to do it right:- Always compare your insurance copay to the cash price using GoodRx or similar apps. Don’t assume insurance is cheaper.

- For generics, use the discount card every time. You’ll almost always save.

- For brand-name drugs, check if the manufacturer has a coupon - but don’t expect big savings. If the discount is less than £5, skip it.

- If you’re on Medicare Part D, don’t use manufacturer coupons unless your plan allows it. Ask your pharmacist or call 1-800-MEDICARE.

- If you can’t afford your meds at all, apply for a patient assistance program. Go to NeedyMeds.org or ask your doctor’s office. They often have staff who help you apply.

- Ask your doctor if a generic or alternative drug is available. Sometimes, switching to a different medication in the same class can save you hundreds.

What’s Changing in 2026

The Inflation Reduction Act is starting to change the game. Starting in 2025, Medicare Part D caps out-of-pocket drug costs at £2,000 a year. That means fewer people will need coupons just to afford their meds. Pharmacies and telehealth apps are also rolling out AI tools that check your insurance and discount options in real time. Soon, you might get one price when you log into your pharmacy app - no switching between cards or coupons needed. But for now, the system is still messy. Discount programs help - but only if you know how to use them. They’re not magic. They’re tools. And like any tool, they work best when you understand how they’re built - and who they’re really helping.What to Do Next

If you’re paying over £15 a month for a prescription, don’t just accept it. Take five minutes right now:- Open the GoodRx app or go to goodrx.com

- Enter your drug name and your postcode

- Compare the cash price to your insurance copay

- If the cash price is lower, print or save the coupon

- Go to your pharmacy and ask them to use it

Do prescription discount cards work with Medicare Part D?

Yes, but only third-party cards like GoodRx. Manufacturer coupons are usually blocked by Medicare Part D plans. You can use GoodRx instead of your insurance - but not alongside it. Always compare the GoodRx price to your Medicare copay before choosing. Sometimes, Medicare is cheaper. Sometimes, GoodRx is.

Can I use a coupon and insurance at the same time?

Generally, no. Most insurance plans, especially Medicare Part D, don’t allow you to combine manufacturer coupons with your coverage. The coupon may be rejected at the counter. If you want to use a coupon, you usually have to pay cash and skip your insurance for that prescription. Always check with your pharmacist first.

Why is the price different at every pharmacy?

Pharmacies set their own cash prices, and discount programs negotiate different deals with each one. A large chain like Boots might have a higher cash price than a small independent pharmacy. GoodRx shows you the lowest price nearby, but you have to go to that specific location. Prices can also change daily based on inventory or supplier deals.

Are prescription discount programs legal in the UK?

Yes, but they work differently than in the US. The NHS covers most prescriptions for a flat fee of £9.90 per item (or free if you qualify). Discount cards like GoodRx are not widely used in the UK because the NHS already sets low prices. However, some people use them for non-NHS medications, private prescriptions, or drugs not covered by the NHS. Always check with your GP first.

Do these programs help with brand-name drugs?

Sometimes, but rarely by much. For brand-name drugs, manufacturer coupons usually save £5-£20 per prescription. That’s not enough to make a big difference unless you’re taking multiple expensive drugs. Third-party cards like GoodRx rarely offer discounts on brand-name drugs - often less than 10%. If you’re paying over £100 a month for a brand-name drug, ask your doctor about generics or patient assistance programs instead.

What’s the best way to save on long-term prescriptions?

Use a 90-day supply instead of 30-day. Many pharmacies offer lower prices per pill for larger quantities. Combine that with a discount card for generics, and you can cut costs in half. Also, talk to your doctor about therapeutic substitution - switching to a different drug in the same class that’s cheaper but equally effective. For example, switching from a brand-name statin to a generic one can save hundreds per year.

Michael Burgess

January 2, 2026 AT 17:33GoodRx saved me £52 on my atorvastatin last month. I didn’t even know my pharmacy was charging me double what the guy two blocks away was charging. Just typed in the drug, clicked ‘cheapest nearby,’ and walked out with my pills for less than my coffee habit. Mind blown. 😲

Angela Goree

January 3, 2026 AT 16:30Wait-so you’re telling me the government lets drug companies rip us off… then lets us use coupons to make it look like they’re helping? That’s not a discount-it’s a shell game. And now we’re supposed to be grateful? 🤬

Brittany Wallace

January 3, 2026 AT 20:10I love how this post doesn’t just say ‘use GoodRx’-it actually explains the mechanics. Like, yeah, coupons feel like a win, but they’re just shifting the burden. It’s like getting a discount on a stolen bike. You’re still paying for the theft, just differently. 🤔

Philip Leth

January 4, 2026 AT 03:44My grandma used to say, ‘If it’s too good to be true, it’s probably a scam.’ These discount cards? They’re the modern version of ‘free money’ flyers in your mailbox. I’ve seen pharmacists stare at them like they’re hieroglyphics. No wonder people get confused.

Kerry Howarth

January 4, 2026 AT 10:32Step one: compare cash vs. insurance. Step two: if cash wins, use it. Step three: tell your doctor. That’s it. No magic. Just math.

Hank Pannell

January 6, 2026 AT 04:02The structural irony here is breathtaking: we’ve created a system where the only way to afford life-saving medication is to circumvent the very infrastructure designed to provide it. The coupon isn’t a solution-it’s a symptom of systemic failure. When the price of insulin is determined by market arbitrage rather than biological necessity, we’ve lost the moral compass. The CBO’s £2.7 billion estimate? That’s not a cost-it’s a moral ledger.

And yet, we’re told to ‘just use GoodRx.’ As if the individual is responsible for fixing a broken architecture. We’re not failing because we don’t know how to navigate the system-we’re failing because the system was never designed for human survival.

What’s next? A coupon for oxygen? A discount card for dialysis? We’ve normalized exploitation as convenience. And now we’re celebrating the illusion of savings as empowerment. It’s not empowerment-it’s triage capitalism.

Until we decouple pharmaceutical pricing from shareholder value, we’re just rearranging deck chairs on the Titanic. The real discount? Universal coverage. The real coupon? Justice.

JUNE OHM

January 7, 2026 AT 22:59GoodRx? That’s a Chinese-backed app! They’re tracking your meds so they can sell your data to Big Pharma! And now you’re telling people to use it? This is how they control us-by making us think we’re saving money while they own our health records! 🇨🇳💀

Liam Tanner

January 9, 2026 AT 10:24Just want to add-PAPs are way underused. I helped my neighbor apply last year. Took 3 weeks, filled out 12 forms, got her free Lyrica for 12 months. No coupons, no hassle. Just human help. If you’re struggling, ask your clinic. They’ve got people who do this all day.

Vincent Sunio

January 10, 2026 AT 07:53It is lamentable that the populace has been conditioned to accept ‘discounts’ as a form of relief, rather than demanding systemic reform. The use of the term ‘savings’ is a semantic sleight-of-hand; one does not ‘save’ money when one is merely avoiding exorbitant, artificially inflated pricing. The correct term is ‘avoided exploitation.’

Furthermore, the suggestion to ‘ask your doctor’ for alternatives presupposes a level of physician autonomy that no longer exists under pharmaceutical influence. The medical-industrial complex has rendered the Hippocratic Oath a footnote.

It is not a failure of individual agency-it is a failure of governance. And yet, we are exhorted to ‘use GoodRx.’ How quaint.

Shanahan Crowell

January 11, 2026 AT 01:22YOU CAN DO THIS. Seriously. Five minutes. Open the app. Compare. Save. Repeat. You’re not broken-you’re just not using the tools. And if you’re on Medicare? Ask your pharmacist BEFORE you pay. They’ll thank you later. 💪❤️