Mar 3, 2010

sales of generics continue to climb

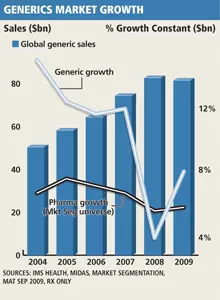

THE GLOBAL generic drug industry has witnessed an almost decade-long sales euphoria and volumes and sales growth of prescription generic drugs continued to increase in 2009.

THE GLOBAL generic drug industry has witnessed an almost decade-long sales euphoria and volumes and sales growth of prescription generic drugs continued to increase in 2009.

In the 12 months ended September 2009, global prescription sales growth of generic drugs climbed by 7.7%, up from 3.6% in 2008, according to US-based health care information and consulting company IMS Health. This compares with the 5.7% growth seen within the overall global pharmaceutical universe last year, says Doug Long, vice-president, industry relations at IMS Health.

During that 12-month period, global generic products generated $83bn (€59.8bn) in audited sales, according to IMS. US market data provider BCC Research estimates that the global market was worth $84bn in 2009.

The global industry virtually had 10 years in a row of good growth – not only in prescriptions but also in sales. All the dynamics of the generics industry were strong and it seems to have even prospered more during the economic slowdown. Generics now account for 72% of the total US pharmaceutical market volume, reaching an all-time high in 2009, he adds. However, they still only account for 17% of total sales, despite generics sales having more than tripled since 2000. In the 12 months ended November 2009, the US generics market was valued by IMS at $31bn. BCC Research estimates the US market in 2009 at $34bn.

The demand for generics is increasing steadily because of pressure to control health care costs. But at the same time, fierce price competition is resulting in slashed profit margins for participating companies. A major growth driver for the generics sector is that several blockbuster pharmaceutical brands are coming off patent and therefore open to generic competition.

The demand for generics is increasing steadily because of pressure to control health care costs. But at the same time, fierce price competition is resulting in slashed profit margins for participating companies. A major growth driver for the generics sector is that several blockbuster pharmaceutical brands are coming off patent and therefore open to generic competition.

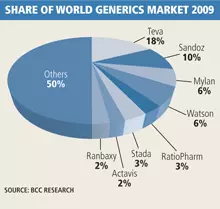

Israel-based Teva Pharmaceutical Industries’ (18% global market share), Switzerland-headquartered Novartis’s US generics business, Sandoz (10%), and both US-based Mylan (6%), and Watson (6%) are leading generics manufacturers, already occupying 40% of the global market. IMS estimates that sales from the top 10 US generic players grew at an average of 13.2% last year.

AT THE TOP

The top four global generics manufacturers – Teva, Sandoz, Mylan and Watson – also accounted for 47% of the US market as of 2009, according to IMS. The top 10, which also includes Canada’s Apotex, Pfizer’s US-based generics business Greenstone, Qualitest Products, Mallinckrodt and Actavis US, all US, and Lupin Pharmaceuticals, the US subsidiary of India-based Lupin, accounted for 66% of the market.

This means there are still many players out there that are pretty small and would be ripe for acquisitions or mergers. Everybody expects that there will be consolidation within the generic drugs industry as smaller producers are experiencing significant margin pressure in this environment.

At the same time, large companies are consolidating their operations in established markets and/or expanding into emerging ones through local acquisitions or partnerships.

In May 2009, Sandoz acquired the specialty generics business of Austria-based Ebewe Pharma, while Teva closed its acquisition of US-based Barr Pharmaceuticals in December 2008.

In December, Teva’s Japanese joint venture, Teva-Kowa Pharma, acquired a 66% stake in generics firm Taisho Pharmaceutical Industries.

In Teva’s 2010-2015 growth strategy announced in early January, the company says it will continue to acquire companies that will boost its market share in attractive geographies as well as enhance its branded business with niche specialty products.

“Only those who are agile and strong will survive in this business,” according to Teva president and CEO Shlomo Yanai during the company’s investor meeting last month in Jerusalem. “About 15% of our business will come from acquisitions. We are taking the necessary steps and building our infrastructure by getting assets and know-how either internally, through acquisition or partnerships.” Teva estimates its 2009 global sales at $13.9bn, of which 70% are from generic products. Yanai is targeting $31bn in sales by 2015, of which 70% will still come from generics.

“There is still room to grow in generics,” says Yanai. “Almost $150bn of branded drugs are going to be off patent in the next five years. This does not include the expiration of biologics, which is an additional $50bn potential.” Teva projects that the global generics market will reach between $135bn and $150bn by 2015. BCC estimates the global market to reach $129.3bn by 2014, representing a 9% annual growth rate.

BOOMING MARKETS

While generics firms are eagerly awaiting the ticking patent expiration of several branded blockbuster drugs, manufacturers are also monitoring the increasing emergence of government health care reforms worldwide.

In almost any given country in the world, you may see different kinds of initiatives or reforms on their own health care systems or even regulating their own pharmaceutical industry. This will increase the pace of generic drug penetration, especially in countries that are asking for better health care.

International markets are especially ripe for generics. In the $59bn global generics market in developed countries, Japan only accounts for 6%, while the US holds 42%, and five major European national markets account for 23%.

China, India, Eastern European countries and Brazil are rising centers of generics activity in emerging markets, Evers adds.

Big pharmaceutical companies are even buying generics firms to get into these emerging markets.As an example France-based Sanofi Aventis’s acquisitions last year of Brazil’s Medley and Mexico’s Kendrick, and in 2008 of Czech Republic-based Zentiva. UK-based GlaxoSmithKline (GSK) acquired Aspen of South Africa in July 2008, while at the same time, Japan’s Daiichi Sankyo acquired India’s Ranbaxy.

US-based Pfizer is now also reportedly in a bidding war against Teva for the acquisition of Germany’s Ratiopharm. In 2009, Ratiopharm holds 3% of the global generics market.

Pfizer started increasing its activities in generics last year with an expanded relationship with Indian firm Aurobindo in March and a commercialization deal with Indian injectable generics specialist Claris Lifesciences. Last month, Pfizer announced a deal with US-based Strides Arcolab to commercialize off-patent sterile injectable and oral products.

At this point, it looks like Pfizer is really geared up towards expanding more into the generics market. Still, not everything is expected to be rosy for the generics market, especially after 2013, when patent expiries will be significantly lower.

The slowing growth in branded blockbusters being developed by research and development-based manufacturers will ultimately lead to fewer opportunities for generics companies.They are now looking ahead and trying to compete in a less crowded and less competitive market such as in biosimilars.

Biosimilars are generic versions of biotechnology-based drugs.

REGULATORS CLOSE IN ON PAY-FOR-DELAY DEALS

Generic and branded pharmaceutical companies are not always at each other’s throats. Both the US Federal Trade Commission (FTC) and the European Commission announced their closer scrutiny of the so-called “pay-for-delay” deals, where branded drug companies pay generics firms to delay the market launch of their generic drugs for a certain period of time.

Last month, the Commission asked companies including AstraZeneca, GlaxoSmithKline and Niche Generics, all of the UK, Gemany’s Boehringer Ingelheim, Novartis and Roche, both Swiss, and France’s Sanofi-Aventis to provide information pertaining to generics settlement agreements in Europe between July 2008 and December 2009.

From now on, the Commission also plans to gather this data on an annual basis in the same way as the FTC, which produces annual reports detailing the type and frequency of settlement agreements undertaken by US pharmaceutical companies.

The FTC released a report in January that claimed that the number of pay-for-delay deals in the US increased from zero in 2004 to a record 19 in 2009. The deals are said to cost consumers $35bn (€25bn) over 10 years. The Commission, meanwhile, estimates that these kinds of deals could have cost European consumers €3bn ($4bn) between 2000 and 2007.