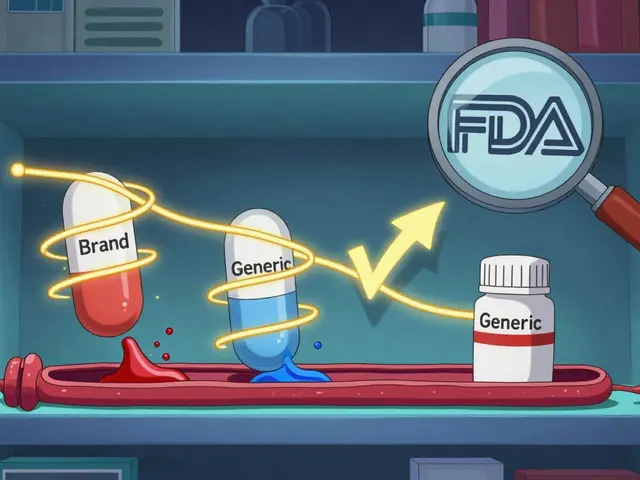

Generic pharmaceutical manufacturers are companies that produce affordable versions of branded drugs after patents expire. They account for 90% of U.S. prescriptions but only 10% of drug spending-yet many struggle to stay profitable.

Key Takeaways

- Traditional commodity generics face razor-thin margins due to intense competition, with gross margins often below 30%.

- Complex generics and contract manufacturing offer higher profits by targeting harder-to-make drugs and specialized services.

- Regulatory hurdles like $2.6 million per FDA application and $100 million facility investments block new entrants.

- Regional differences matter-Europe has better margins than the U.S., while emerging markets offer growth but with risks.

- Patent expirations of blockbuster drugs by 2033 could revive the industry, but only if companies pivot to higher-value products.

Why Generic Drug Manufacturers Struggle to Stay Profitable

It’s simple math: when a brand-name drug’s patent expires, dozens of generic companies rush to make copies. This floods the market, driving prices down fast. For example, a drug that sold for $100 per pill as a brand might drop to $10 for generics. With so many competitors, companies fight for market share by slashing prices further. Some manufacturers now operate with gross margins below 30%-down from 50-60% just a decade ago. Teva Pharmaceutical Industries Ltd reported a -4.6% profit margin in 2025, losing $174.6 million despite $3.79 billion in revenue. That’s not sustainable long-term.

But here’s the catch: these companies save patients and healthcare systems billions. The FDA estimates generic drugs generated $18.9 billion in savings in 2022 alone. Yet, the profit squeeze means some essential medicines face shortages because no one can make them profitably. Dr. Aaron Kesselheim from Harvard Medical School calls this a market failure. So why do companies keep trying?

Three Business Models for Survival

Generic manufacturers aren’t giving up-they’re adapting. Three main strategies are emerging:

- Commodity generics: These are simple, off-patent drugs like ibuprofen or metformin. Hundreds of companies make them, so margins are razor-thin. Companies like Teva once relied on this model but now struggle to stay profitable.

- Complex generics: These include hard-to-formulate drugs, combination products, or specialty generics. For example, Teva’s Austedo XR for movement disorders has fewer competitors, allowing higher prices and margins. This segment is growing as manufacturers shift toward technical barriers that block new competitors.

- Contract manufacturing: Instead of making their own branded drugs, companies like Egis Pharmaceuticals produce drugs for others. This segment is projected to grow from $51.96 billion in 2024 to $90.95 billion by 2030. It’s less risky because they’re paid for production, not dependent on drug pricing.

Viatris, formed from Mylan and Upjohn, shifted away from commodity generics by selling non-core assets and focusing on complex generics. Teva, meanwhile, increased R&D spending to $998 million in 2024 for immunology and biosimilars. Both companies are betting on higher-value products to survive.

Biggest Challenges Beyond Price

It’s not just about low prices. Getting a generic drug approved is expensive and time-consuming. Each FDA application (ANDA) costs an average of $2.6 million. Building a compliant manufacturing facility? Over $100 million. And it takes 18-24 months just to get regulatory approval. McKinsey & Company found 65% of companies focusing on commodity generics fail within two years.

Then there’s the "pay for delay" problem. Brand companies sometimes pay generics to delay launching their version. A Blue Cross Blue Shield study says banning this would save $45 billion over 10 years. But it also shows how the system is stacked against generic makers. pharmacy benefit managers (PBMs) in the U.S. squeeze prices even further, making it harder for manufacturers to profit.

Regional Differences Matter

Profitability isn’t the same everywhere. In North America, the U.S. pharmacy benefit manager system drives prices down hard. Europe has better margins due to different pricing rules. Meanwhile, emerging markets like India and Brazil offer growth potential but come with currency risks and unstable regulations. For example, India’s generic industry thrives on low-cost manufacturing, but companies there face challenges in quality compliance and export regulations.

The U.S. market is shrinking-IBISWorld reports a 6.1% annual decline in generic manufacturing revenue through 2025. But globally, the market is expected to hit $600 billion by 2033. That growth will come from complex generics, biosimilars, and contract manufacturing, not commodity drugs.

What’s Next for the Industry?

Companies that adapt will survive. Teva’s shift to specialty generics and biosimilars is paying off-it grew revenue by 4% in 2024. Viatris is focusing on core products after divesting non-essential parts. Contract manufacturing is booming as more companies outsource production. The key is moving away from simple, low-margin drugs toward complex formulations and specialized services.

Patent expirations on major drugs like Humira and Keytruda between 2025-2033 will create new opportunities. But only if manufacturers can navigate the regulatory and pricing challenges. The industry’s survival depends on balancing affordability with sustainable business models. Otherwise, shortages of essential medicines will keep happening.

Frequently Asked Questions

Why do generic drug manufacturers struggle with profitability?

Generic drug manufacturers face intense price competition once a brand-name drug’s patent expires. With dozens of companies making the same drug, prices drop rapidly. Many now operate with gross margins below 30%, down from 50-60% in previous years. Companies like Teva reported negative profits in 2025, while FDA approval costs average $2.6 million per application and manufacturing facilities require over $100 million in investment.

What are complex generics and why are they more profitable?

Complex generics include hard-to-formulate drugs, combination products, or specialty medications with technical barriers to entry. For example, drugs like Teva’s Austedo XR for movement disorders have fewer competitors because they require advanced manufacturing expertise. This allows higher prices and better margins-often 40-60% gross margins compared to 20-30% for simple generics. Companies investing in these areas are seeing growth despite industry-wide challenges.

How do contract manufacturing organizations (CMOs) help generic companies stay profitable?

CMOs produce drugs for other companies instead of selling their own branded products. This reduces risk because they’re paid for manufacturing services, not dependent on drug pricing. The global CMO market is projected to grow from $51.96 billion in 2024 to $90.95 billion by 2030. Companies like Egis Pharma Services are expanding into this space, offering API development and manufacturing for both brand and generic companies. It’s a safer, more stable business model in a volatile industry.

Why do some essential medicines face shortages despite high demand?

When the profit margin for a drug is too low, manufacturers stop making it. For example, some generic antibiotics or chemotherapy drugs have such thin margins that companies can’t cover production costs. Harvard Medical School’s Dr. Aaron Kesselheim calls this a market failure-society needs these drugs, but the current system doesn’t reward manufacturers for producing them. This leads to shortages that affect patient care.

What role do pharmacy benefit managers (PBMs) play in generic drug pricing?

PBMs negotiate drug prices between insurers, pharmacies, and manufacturers. In the U.S., they often force generic manufacturers to accept lower prices to secure formulary placement. This squeezes margins further-some manufacturers sell drugs at a loss just to stay in the market. PBMs also have ties to brand-name companies, which sometimes leads to "pay for delay" agreements where generics are paid to delay entry. These practices keep generic drug prices low but make profitability nearly impossible for many companies.

Danielle Vila

February 7, 2026 AT 03:17Big Pharma is pulling strings behind the scenes to keep generic manufacturers in the dark.

They're paying off regulators and PBMs to block competition-this isn't just business, it's a full-blown conspiracy!

I've got the inside scoop, trust me. The FDA application fees? Total scam.

They're just trying to keep small players out so they can control the market.

And don't even get me started on how PBMs squeeze manufacturers for profit. It's all rigged!

Thorben Westerhuys

February 8, 2026 AT 22:19FDAs fees are absolutely insane! $2.6 million per application?

And $100 million for facilities?

How can any company survive this?

It's a disaster!

The system is completely broken...

I can't believe how unfair this is!

Someone needs to fix this immediately!

Jennifer Aronson

February 9, 2026 AT 03:14The structural challenges in the generic drug industry are significant.

However, the shift towards complex generics and contract manufacturing seems logical.

Regional disparities in profitability warrant closer examination.

Sustainable business models require strategic diversification.

Gregory Rodriguez

February 11, 2026 AT 02:33The classic 'savings for patients' argument is laughable.

While we're all saving billions, manufacturers are going broke.

It's like saying 'save the world for free!'

Maybe pay them fairly for the work they do.

Oh wait, we don't. Because saving money matters more than drug availability.

Brilliant strategy, guys.

Pamela Power

February 11, 2026 AT 19:26Generic manufacturers are incompetent.

They should have diversified years ago.

Instead, they're whining about margins.

If they can't handle competition, they should fold.

No wonder there are shortages-these companies are poorly run.

It's not the system's fault; it's theirs.

Sam Salameh

February 13, 2026 AT 08:48America needs to step up and produce these drugs here!

Why are we outsourcing everything?

It's a national security issue.

We need to invest in domestic manufacturing and bring jobs back.

We can't rely on foreign countries for essential medicines.

Let's make America great again by making drugs here!

Cullen Bausman

February 14, 2026 AT 04:16Manufacturers must prioritize quality and efficiency or exit the market.

Cole Streeper

February 15, 2026 AT 05:05Foreign interference is the real problem.

China and India are flooding the market with cheap generics.

They're using unfair trade practices to undermine US manufacturers.

We need tariffs and strict import controls.

This is economic warfare, and we're losing.

Wake up, America!

Dina Santorelli

February 16, 2026 AT 15:00Jennifer's comment is so bland.

Like, 'strategic diversification'-what does that even mean?

The real issue is companies aren't good at business.

They keep making the same mistakes.

And the shortages? Total mess.

It's all so frustrating.

Just sad.

Arjun Paul

February 16, 2026 AT 20:11India's generic industry thrives due to strong manufacturing capabilities and lower costs.

However, lack of R&D investment for complex generics limits growth.

Quality control remains a challenge for many Indian firms.

The global market requires higher standards, and Indian companies must adapt or lose competitiveness.